Best Health & Life Insurance Options for Beginners: A 2025 Guide

Insurance is the foundation of financial security and well-being, yet most beginners are unsure how to start. With medical expenses and uncertainties rising, choosing the right insurance is a critical first step. Here’s what every first-timer should know:

Understanding the Basics

- Health Insurance covers medical expenses—hospitalization, surgeries, and sometimes daycare procedures. It shields your savings if you face illness or accident, providing cashless treatment or reimbursement.

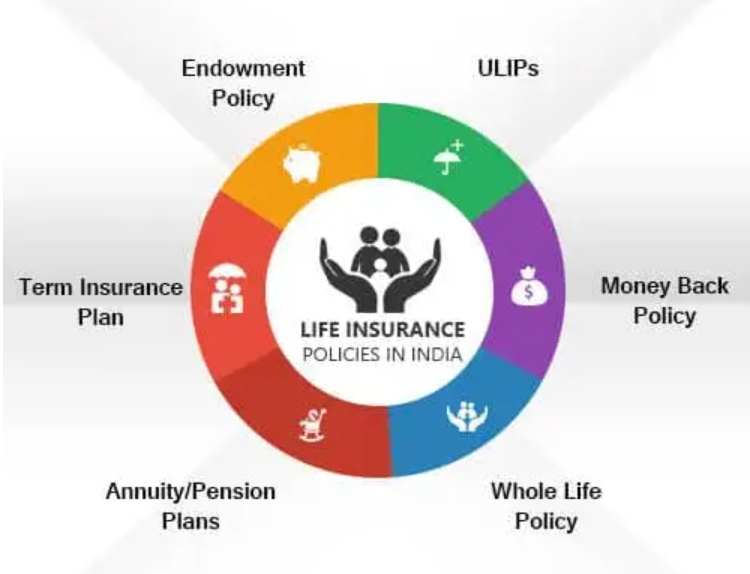

- Life Insurance is designed to support your family financially if you are no longer there, offering a lump sum or regular payouts. It comes in many forms: term plans, savings plans, and investment-linked policies.

Top Health Insurance Picks for Beginners (2025)

- HDFC Ergo Optima Secure: Balanced and affordable with extensive hospital network, high claim settlement ratio, and flexible add-ons.

- Care Supreme, Aditya Birla Activ One MAX: Best for customization and comprehensive coverage.

- ICICI Lombard Complete Health: Offers lifelong renewal and wellness benefits.

- Star Health Family Health Optima & Apollo Munich Easy Health: Known for affordable premiums and wide coverage, including maternity benefits for young families.

- Bajaj Allianz Family Floater, Tata AIG MediCare Premier: Strong hospital reach, cashless benefits, and global coverage options.

Choosing the Right Life Insurance

- Term Plans: Pure protection at low cost. E.g., HDFC Life Click 2 Protect Super, ICICI Prudential iProtect Return of Premium, Bajaj Allianz e Touch II—offering high coverage (₹1–2 crore) and strong claim ratios.

- ULIPs/Pension Plans: Combine protection with savings/investment (SBI Life Wealth Assure, HDFC Life Click 2 Wealth, LIC New Jeevan Shanti).

Key Differences

- Health insurance helps with medical bills during your life; life insurance provides for your family after your passing.

- Both offer tax benefits—Section 80D for health and 80C for life insurance.

- Beginners should ideally start with an affordable term life insurance and an individual or family health plan.

What To Look For

- Claim settlement ratio (above 95%)

- Hospital network (6,000+ preferred for cashless claims)

- Waiting period, exclusions, premium costs

- Customization options and renewability

Final Tips for Beginners

- Buy enough coverage for your needs, avoid relying solely on employer-provided insurance.

- Start early—premiums are lower and current health status matters.

- Use comparison platforms for the latest features and prices.

- Review and update coverage as your family and income grow.

Securing robust health and life insurance is the most important investment you’ll make for both peace of mind and protection against life’s uncertainties. Start now, and let insurance work for your future!