A Systematic Investment Plan (SIP) is one of the simplest ways for a beginner to start investing in mutual funds. It lets you invest small, fixed amounts regularly instead of arranging a big lump sum.

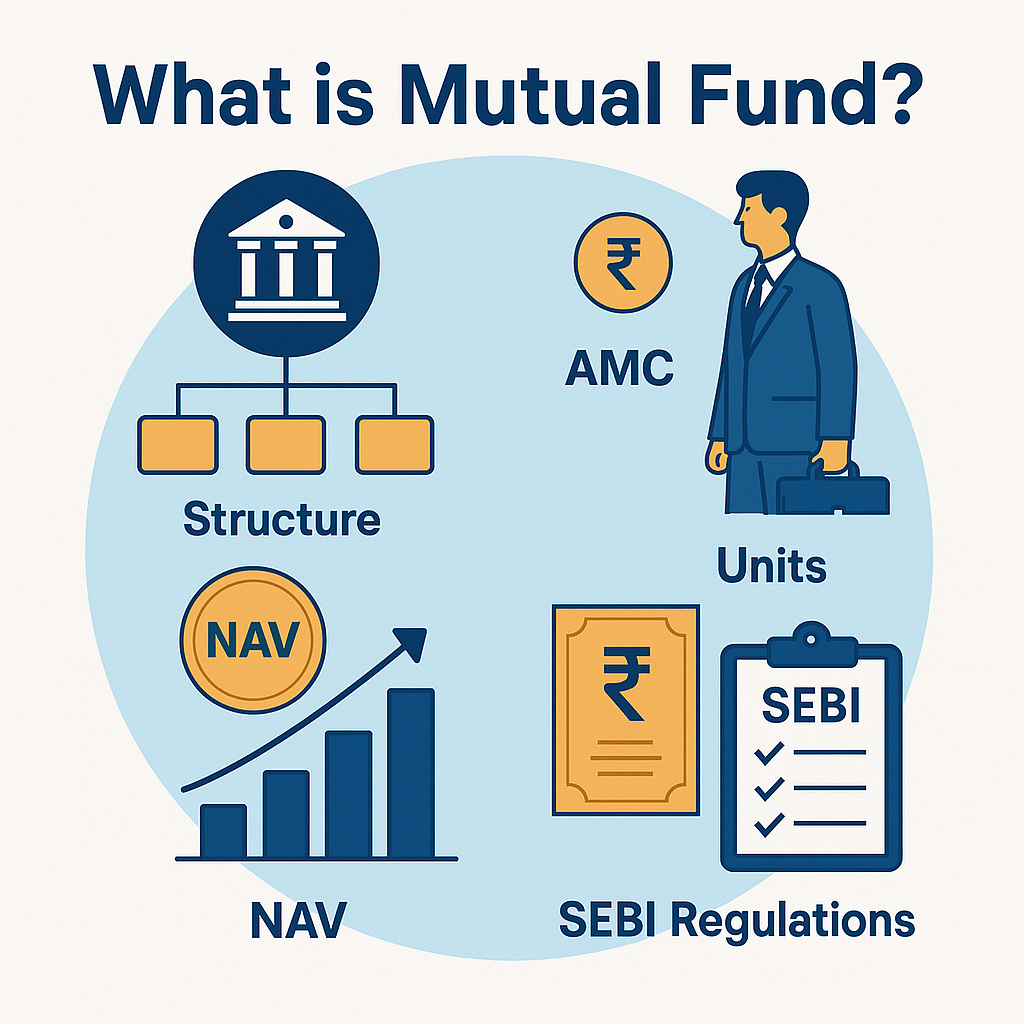

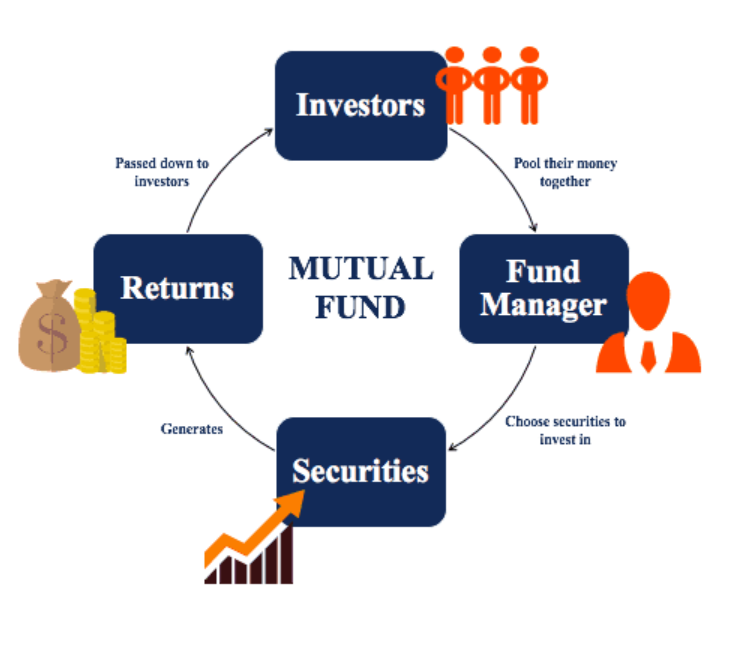

In a SIP, you choose a mutual fund, the amount you want to invest, and how often you want to invest (usually monthly). On the chosen date, the amount is automatically debited from your bank account and invested into the fund, just like an automated savings habit. In return, you receive “units” of the mutual fund based on its Net Asset Value (NAV) on that day.

Because the NAV changes daily, your SIP sometimes buys more units (when prices are low) and sometimes fewer (when prices are high). Over time, this strategy, called rupee cost averaging, helps smooth out the effect of market ups and downs. Staying invested for many years also lets you benefit from compounding, where any returns you earn are reinvested and start earning returns of their own.

For beginners, SIPs offer several advantages:

- They build a disciplined saving and investing habit.

- You can start with a small amount and gradually step it up as your income grows.

- You don’t need to time the market or track prices every day.

To begin, define your goal (like retirement, a house, or education), decide your time horizon, and pick a suitable mutual fund category (equity for long term, debt for short term, or hybrid for a mix). Then set up a SIP through your bank or an investment platform, enable auto-debit, and let the plan run for the long term. Always review your SIP once a year to ensure it still matches your goals and risk comfort.