Term insurance and life insurance both protect your family, but they work very differently and serve different goals.

Term insurance is pure protection. It covers you for a fixed period, such as 20 or 30 years, and pays a lump sum to your nominee if you pass away during this term. There is usually no payout if you survive the policy period, which is why premiums are much lower and you can get a very high cover at an affordable cost. This makes term plans ideal if your main aim is to secure your family’s lifestyle, repay loans, and protect long-term goals like children’s education in case of an early death.

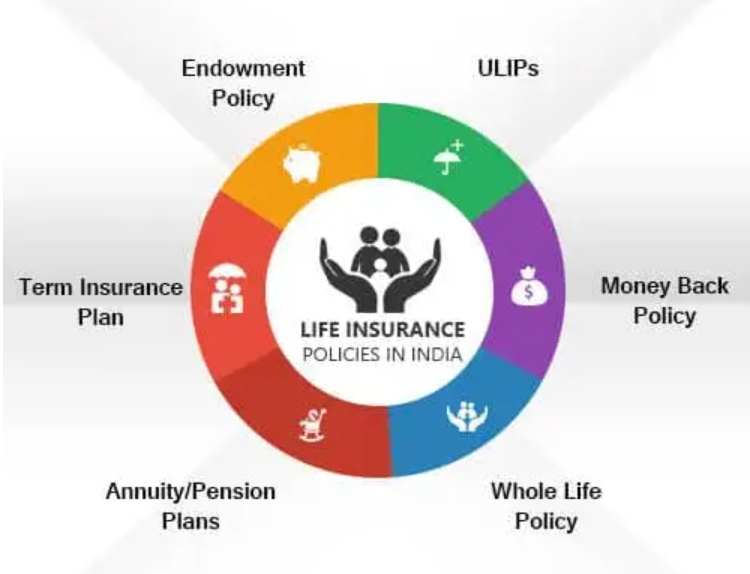

Life insurance is an umbrella term that also includes savings-oriented plans like endowment and whole-life policies. These plans combine life cover with a savings or investment component. If you die during the policy term, your nominee receives the sum assured. If you survive till maturity, you usually get a lump sum back, sometimes with bonuses, which can be used for goals like retirement or children’s education. Because of this dual benefit, premiums are significantly higher, and the coverage amount is often lower compared to term insurance for the same budget.

For most young earners, a large term cover is the most efficient way to buy protection. You can then separately invest in mutual funds, SIPs, or other products to build wealth. Life insurance plans with savings elements may suit someone who prefers a bundled, disciplined product and is comfortable paying higher premiums for guaranteed maturity benefits. The right choice depends on your income, dependents, existing investments, and whether your priority is maximum protection, long-term savings, or a mix of both.