Introduction to Mutual Funds

Mutual funds have become one of the most popular investment vehicles in India, thanks to their simplicity, diversification, and professionally managed structure. If you’ve ever wondered “What is a Mutual Fund?” — this comprehensive guide will walk you through its structure, sponsors, AMC, NAV, units, and even the regulatory framework laid down by SEBI.

Whether you’re a beginner or brushing up your financial knowledge, this article will break it all down in an easy-to-understand format.

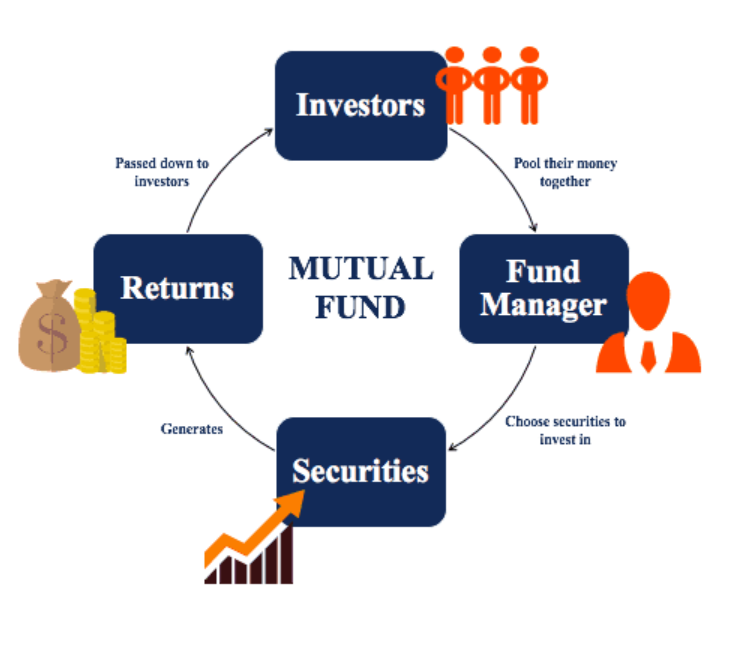

What is a Mutual Fund?

Definition and Meaning

A mutual fund is a financial instrument that pools money from multiple investors and invests it in various assets like stocks, bonds, and other securities. The money is managed by a professional fund manager who attempts to earn returns for the investors, who in turn become “unit holders” in the fund.

History and Evolution in India

Mutual funds made their first appearance in India in 1963 with the Unit Trust of India (UTI). Over the decades, with liberalization and increasing financial awareness, the mutual fund industry has seen explosive growth. Now regulated by SEBI, it is one of the safest and most transparent investment options available today.

Why Do People Invest in Mutual Funds?

Benefits of Mutual Funds

- Diversification – Spreads risk across multiple assets.

- Professional Management – Managed by experienced fund managers.

- Liquidity – Easy to buy or redeem units anytime (for open-ended funds).

- Affordability – Start investing with as low as ₹100 through SIPs.

- Transparency – SEBI mandates regular disclosures.

Risks Associated with Mutual Funds

- Market volatility

- Management risk

- Interest rate risk (for debt funds)

- Exit load or redemption charges

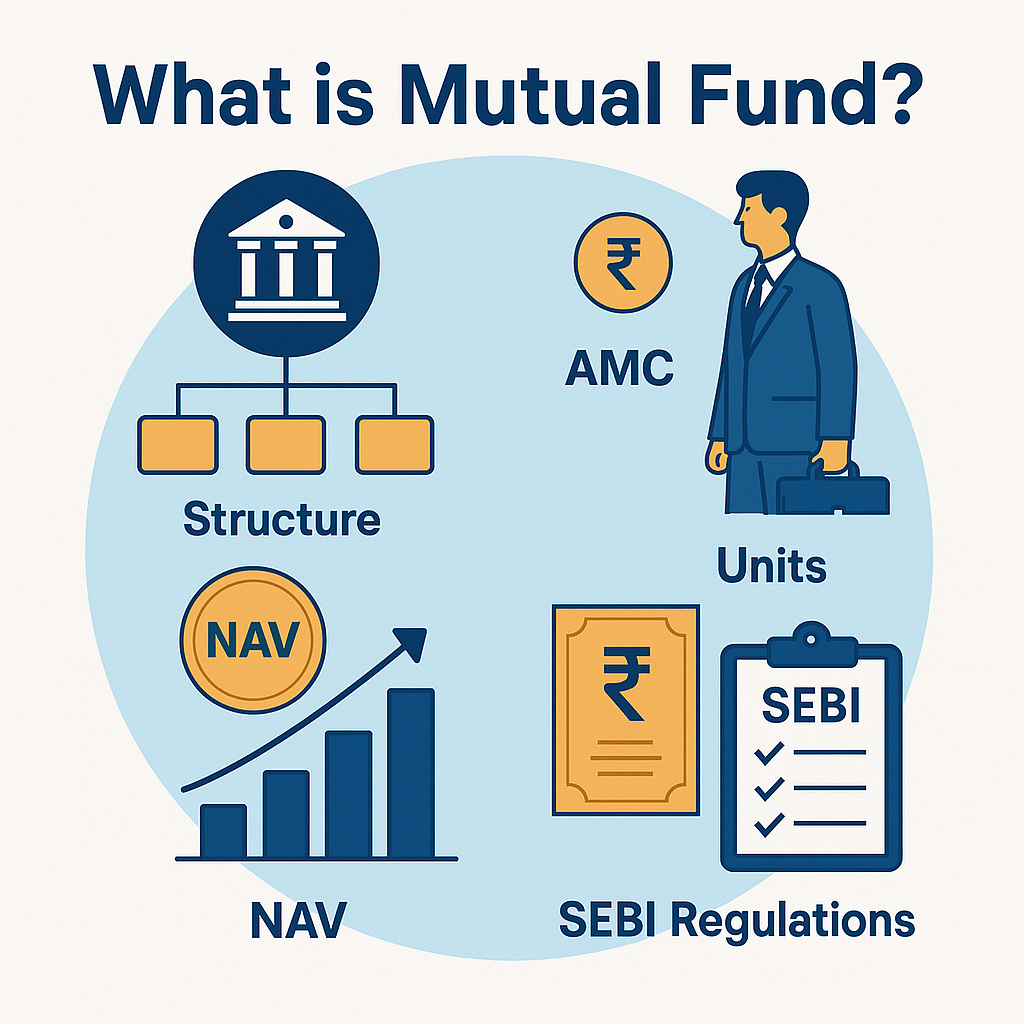

Structure of a Mutual Fund in India

Key Entities in the Structure

The mutual fund ecosystem in India comprises several important entities:

Sponsor

The sponsor is similar to a promoter in a company. It sets up the mutual fund and must meet SEBI’s eligibility norms.

Mutual Fund Trustee

Trustees are appointed to ensure that the AMC functions in the interest of the investors. They act as overseers.

Asset Management Company (AMC)

The AMC is the actual investment manager that makes decisions on which securities to buy or sell.

Custodian

Responsible for holding the securities and ensuring proper settlement of transactions.

Legal and Regulatory Setup

All mutual funds are established under the Indian Trusts Act, 1882 and are governed by SEBI’s Mutual Fund Regulations, 1996.

Role of Sponsors in Mutual Funds

Eligibility Criteria

Sponsors must have a strong track record, financial soundness, and at least a 40% stake in the AMC.

Functions and Responsibilities

- Set up the mutual fund trust

- Appoint trustees and AMC

- Ensure regulatory compliance

What is an AMC (Asset Management Company)?

Functions of an AMC

- Manage the fund portfolio

- Conduct research and market analysis

- Ensure compliance and performance tracking

Relationship with Investors

The AMC charges a management fee and is answerable to both trustees and investors. Performance transparency is mandated by SEBI.

Understanding NAV (Net Asset Value)

How NAV is Calculated

NAV=(TotalAssets−Liabilities)/TotalNumberofUnitsNAV=(TotalAssets−Liabilities)/TotalNumberofUnits

This value is declared daily and reflects the per-unit price of the mutual fund.

Importance of NAV in Fund Performance

NAV helps in comparing funds, understanding price movements, and calculating returns. However, it should not be the only factor while selecting a fund.

Units in Mutual Funds Explained

What Are Mutual Fund Units?

When you invest in a mutual fund, you’re allotted a certain number of “units,” similar to shares in a company.

Buying and Selling Units

Units can be purchased or sold at NAV plus applicable charges. In open-ended schemes, buying and selling can happen anytime, whereas closed-ended funds have a fixed maturity.

SEBI Regulations on Mutual Funds

Regulatory Framework

SEBI regulates mutual funds under the SEBI (Mutual Funds) Regulations, 1996.

SEBI’s Role in Investor Protection

- Mandates disclosures

- Ensures fair valuation of assets

- Regulates fund advertisements

Key Guidelines Mutual Funds Must Follow

- Risk categorization

- Expense ratio caps

- Regular reporting of portfolio and performance

Types of Mutual Funds in India

India’s mutual fund market offers a wide variety of fund types to cater to the needs of every kind of investor.

Based on Asset Class

- Equity Mutual Funds – Invest majorly in stocks and aim for high returns over the long term. Suitable for aggressive investors.

- Debt Mutual Funds – Invest in bonds, treasury bills, and government securities. Lower risk and better suited for conservative investors.

- Hybrid Funds – A mix of both equity and debt, offering balanced risk and return.

Based on Investment Objectives

- Growth Funds – Aim for capital appreciation over time.

- Income Funds – Aim to provide regular income to investors.

- Tax-Saving Funds (ELSS) – Offer tax benefits under Section 80C of the Income Tax Act.

- Liquid Funds – Short-term funds that invest in money market instruments.

How to Invest in a Mutual Fund?

Step-by-Step Process

- Know Your Risk Appetite – Assess your risk tolerance and investment goals.

- Choose the Right Fund – Use performance, risk, and fund house reputation to make a decision.

- KYC Compliance – Complete your KYC (Know Your Customer) process.

- Select Mode of Investment – Either SIP (Systematic Investment Plan) or lump-sum.

- Start Investing – Use platforms like AMC websites, brokers, or apps.

Choosing the Right Fund

- Compare funds based on 3-5 year performance

- Check the expense ratio

- Look for consistent fund managers

- Read the scheme information document (SID)

Taxation of Mutual Funds in India

Understanding taxation is crucial when investing in mutual funds, as it affects your net returns.

Tax on Capital Gains

- Equity Funds:

- Short-Term Capital Gains (STCG): 15% (holding less than 12 months)

- Long-Term Capital Gains (LTCG): 10% (above ₹1 lakh annually, holding over 12 months)

- Debt Funds:

- STCG: Added to income and taxed as per slab

- LTCG: 20% with indexation (if held over 36 months)

Tax Benefits

- ELSS Funds – Up to ₹1.5 lakh can be claimed as deduction under Section 80C.

- No TDS on capital gains from mutual funds (as of current rules).

Top Mutual Fund Houses in India (2025)

Best Performing Fund Managers

| Fund House | Notable Fund Manager | AUM (₹ Cr) | Top Performing Fund |

| SBI Mutual Fund | R. Srinivasan | ₹8.5 Lakh Cr | SBI Small Cap Fund |

| HDFC Mutual Fund | Chirag Setalvad | ₹6.2 Lakh Cr | HDFC Flexi Cap Fund |

| ICICI Prudential | Sankaran Naren | ₹5.9 Lakh Cr | ICICI Bluechip Fund |

| Axis Mutual Fund | Jinesh Gopani | ₹2.8 Lakh Cr | Axis Long Term Equity |

Comparison Table

| Criteria | SBI MF | HDFC MF | ICICI Pru | Axis MF |

| Expense Ratio | Low | Moderate | Low | High |

| Returns Consistency | High | High | Moderate | High |

| Customer Experience | Good | Excellent | Good | Very Good |

Common Mistakes to Avoid When Investing in Mutual Funds

- Chasing Past Returns – Past performance doesn’t guarantee future results.

- Ignoring Expense Ratios – High charges eat into your returns.

- Not Diversifying – Putting all money in one type of fund increases risk.

- Investing Without Goal – Always align investment with a financial objective.

- Frequent Switching – Reacting to market noise can harm long-term gains.

Future of Mutual Funds in India

The mutual fund industry in India is expected to grow at a CAGR of 18–20% over the next five years. With increasing investor education, digitization, and SEBI reforms, more retail investors are entering the market. The rise of passive investing and thematic funds is also reshaping the landscape.

Conclusion

In summary, mutual funds are an excellent investment avenue for both novice and seasoned investors. They offer diversification, professional management, and regulated transparency, making them a reliable wealth-building tool. By understanding What is a Mutual Fund?—along with its structure, key entities like AMCs and sponsors, NAV calculation, and SEBI rules—you are better equipped to make sound financial decisions.

FAQs About Mutual Funds

1. What is the minimum amount required to invest in a mutual fund?

You can start with as little as ₹100 through SIP in many funds.

2. Are mutual funds safe to invest in?

They carry market-related risks, but are regulated by SEBI, making them relatively safer than many unregulated investment options.

3. What is the difference between SIP and lump-sum investment?

SIP is a periodic investment method, while lump-sum is a one-time investment. SIP is better for rupee-cost averaging.

4. How do I withdraw money from a mutual fund?

Log into your investment portal or AMC website and place a redemption request. The amount will be credited to your bank.

5. Can NRIs invest in Indian mutual funds?

Yes, most mutual funds accept investments from NRIs except from countries with regulatory restrictions like the US or Canada.

6. How frequently is NAV updated?

NAV is typically updated at the end of each trading day.